Ayush Rodrigues

Jul 23, 2024

Today, I noticed that issuing banks in Saudi Arabia and the UAE have incredible win rates for chargebacks (80-90%). Why?

Digging through the data, it seems that certain banks have a much higher rate of declining pre-arbitration: ie, they see the merchant's chargeback representment, and reject it at a far higher rate than other banks.

Their pre-arb response often has nothing to do with the rebuttal and simply claims that the cardholder still rejects having a part in the transaction, even if the evidence suggests otherwise.

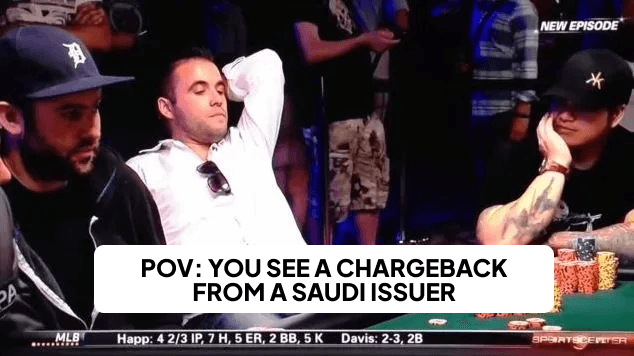

Their willingness to escalate a chargeback to arbitration seems like a game of poker: challenging the merchant to call their bluff and risk the hefty $500 arbitration fee.

Many banks in the UAE have the funds to make win rates and scheme compliance an afterthought, so they can force their way into higher win rates by playing the hand of merchants who don't want to take the gamble.

What can we learn? Issuers need to stand their ground and know when they can escalate cases. Having a good dispute team that understands the scheme rules and how to argue cases will move the needle.

Reach out to us if you want to have an informal chat about improving your chargeback and dispute process. We help issuers achieve lower operational overhead, a better cardholder experience, and improved chargeback win rates!